Cost of living was one of the top concerns for Americans heading into the 2025 midterm elections.1 Depending on where you live, utility bills can account for up to almost 14% of your income each month. To find out which US states pay the most for utilities, we researched energy bills, natural gas costs, water and sewer bills, internet and phone costs, and more to find out each state's average utility bill.

Utility Bills 101: Average Monthly Cost of Utilities by State and Nationally

For over 8 years Move.org experts have examined pricing, credentials, and real customer reviews to give you (human) recommendations you can trust. See how we review.

Let’s face it: Nobody likes paying utility bills. They pop up each month and keep you from putting your paycheck toward more exciting areas of your budget, like your vacation fund—or that fun subscription box you've always wanted with specialty coffees, cocktails, snacks or gadgets.

No matter what you’re saving for, utility bills are a burden we all have to bear. But which states’ residents bear the largest burden? We crunched the numbers so you can see how the average monthly utility costs in your state stack up against the rest. We looked at both the total cost and the percent of your monthly income spent on utilities.

In this article:

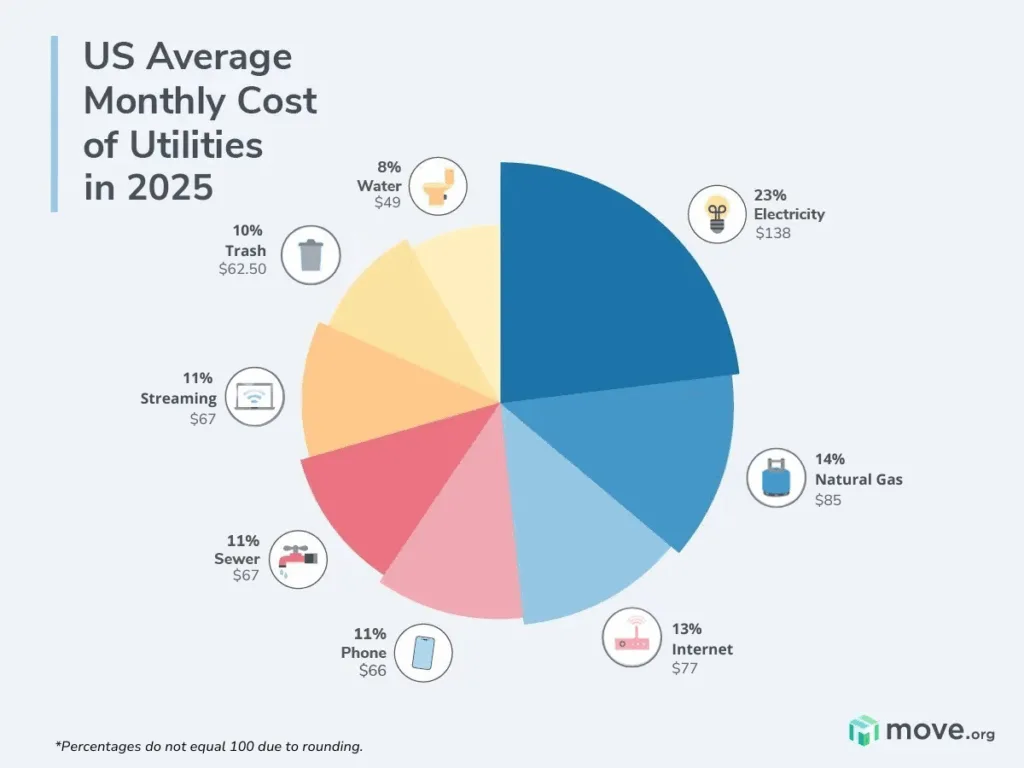

US average monthly utility bill cost: $611 (↑up compared to last year's $583)

Whether you’re getting settled in a new home or planning a move, budgeting for monthly utility costs can make life a lot easier. On average, most US households spend around $401 per month on essentials like electricity, natural gas, water, and sewer. When you add in internet, phone, and streaming services, that typical utility cost reaches $611 per month.

Of course, utility costs vary based on your state, local climate, and energy rates. We’ve looked at the average utility bills across the country so you can see how your state compares to the national average. Keep reading to find out which states have the highest and lowest average utility bill costs and discover tips to help you save on your energy bill no matter where you live.

We update our national data and findings for each state every year to keep things accurate. However, we know that utility costs (like electricity and natural gas) can change with inflation. See how inflation impacts your utility bills.

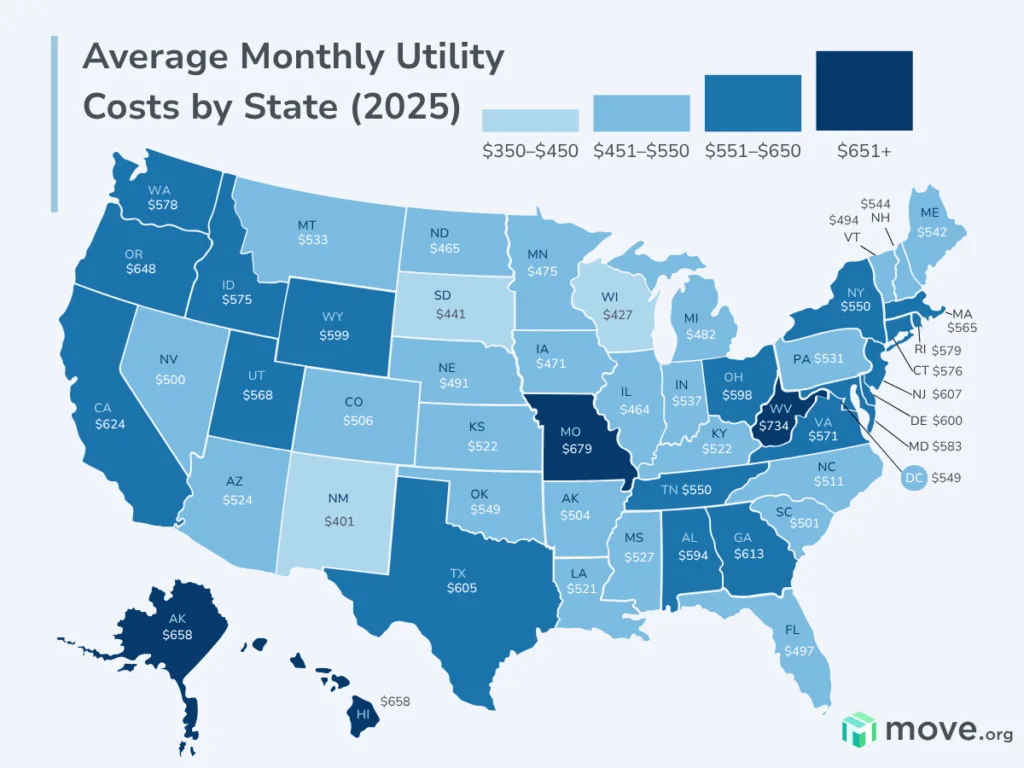

Average monthly utility costs by state: Which states pay the most?

Now that we’ve discussed the national averages for utility expenses, let’s talk about how much utilities cost per month in different states.

Utility cost trends in 2025

- Electricity tops the list as the most expensive part of a typical monthly utility bill, while water typically remains the least costly (depending on where you live).

- Compared to last year, average costs for electricity, natural gas, water, sewer, and streaming services have all gone up, while average trash, internet, and phone expenses have remained the same.

- 7 states have average utility bills higher than the national average: West Virginia ($734), Missouri ($679), Alaska ($658), Hawaii ($658), Oregon ($648), California ($624), and Georgia ($613).

- In 6 states, utility costs exceed 10% of the state’s median monthly income: West Virginia (13.95%), Mississippi (11.29%), Alabama (10.87%), Missouri (10.4%), Louisiana (10.29%), and Oklahoma (10.09%).

- 13 states spend a larger percentage of monthly income on utilities than the national average: West Virginia, Mississippi, Alabama, Missouri, Louisiana, Oklahoma, Kentucky, Arkansas, Wyoming, North Carolina, Georgia, Ohio, and Texas.

- On average, the monthly cost of utilities increased by $28 compared to last year.

- New Jersey and Alaska saw the biggest increase in monthly utility costs. Residents in each state pay an average of $102 more per month compared to the previous year.

- 3 states saw a year-over-year decrease in monthly utility expenses: Hawaii (↓$98), Florida (↓$24), and Arizona (↓$3).

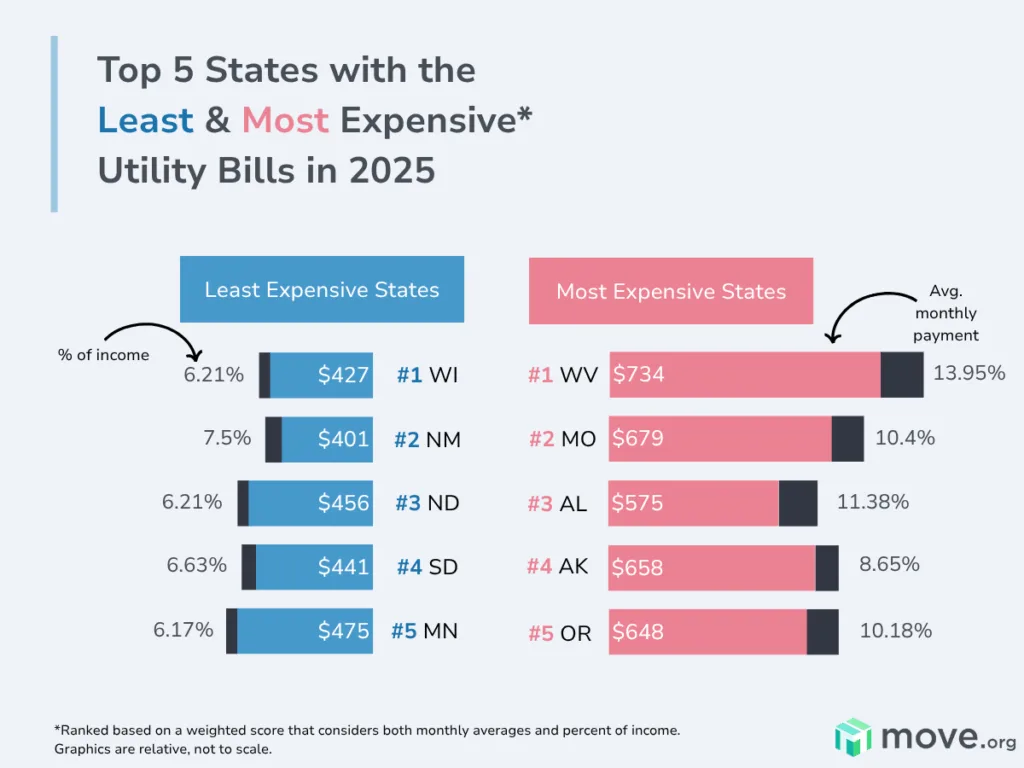

The top 5 states with the most expensive utilities (based on % of income)

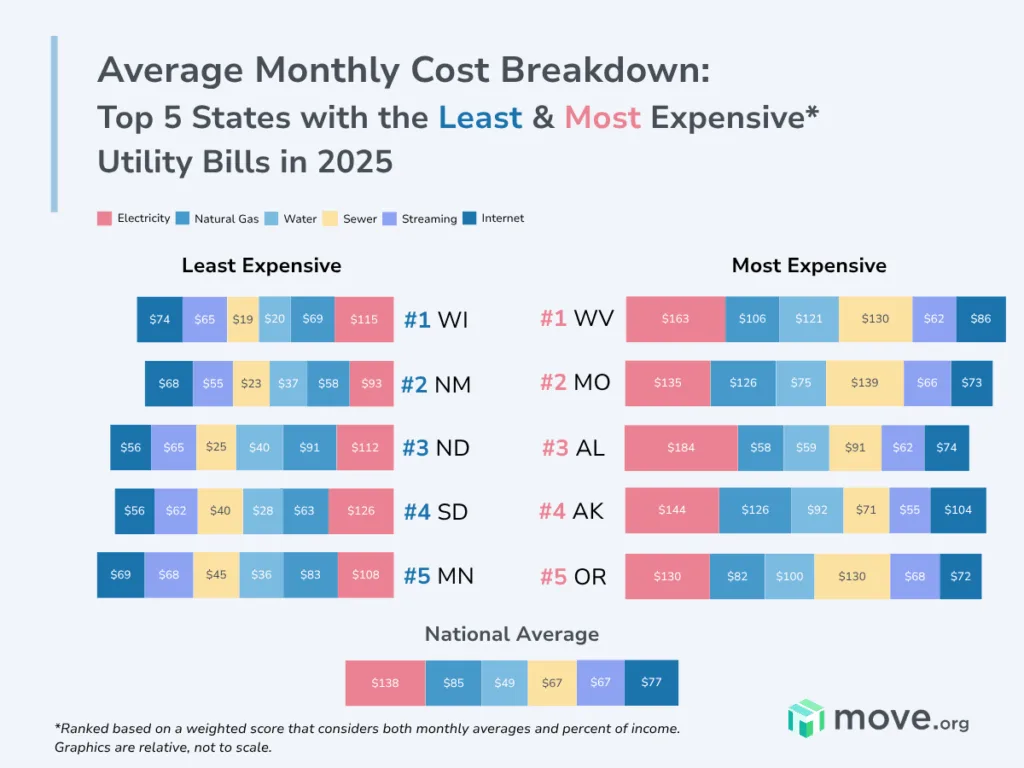

1. West Virginia: $734/mo. | 13.95% of income

We’re sorry, West Virginia, but you’ve earned the top spot for utility costs as a percentage of income and for the highest average cost of utilities overall. Residents of The Mountain State also face the highest average water bill in the country at $121 per month—far above the national average of $49 per month for a typical water bill. This rise is partly due to the increased Distribution System Improvement Charge (DSIC), which goes toward infrastructure upgrades and improved water quality. Overall, West Virginians pay about $42 more per month for utilities compared to last year.

2. Missouri: $679/mo. | 10.4% of income

Missouri jumped to the second spot this year after ranking fourth last year. Residents of The Show-Me State pay the second-highest utility bills in the nation, and they saw a $73 average increase in their monthly utility bills compared to last year. Missourians pay the third-highest sewer bills and fourth-highest natural gas bills in the nation.

3. Alabama: $575/mo. | 11.38% of income

Alabama’s hot summers mean some of the highest electricity bills in the US, with seven out of 10 residents relying on electric power to cool their homes. Electricity costs the average Alabaman $184 per month and makes up more than 30% of the total utility bill. The increased cost of electricity was balanced out by a decrease in natural gas costs, resulting in an average year-over-year utility bill increase of about $19 in The Yellowhammer State.

4. Alaska: $658/mo. | 8.65% of income

Alaska ranked 21st on last year's list but rocketed up to fourth place for 2025. A surge in natural gas prices seems to be behind the $102 average increase in Alaskans' monthly utility bills. Residents of The Last Frontier pay the third-highest utility bills nationwide. Electricity, water, sewer, and internet services also cost above-average in this state.

5. Oregon: $648/mo. |10.18% of income

Climbing from eighth to fifth in our rankings, Oregon has seen the cost of electricity, natural gas, water, and sewer services rise over the last year. Residents of The Beaver State still pay below average for electricity and natural gas, but their typical water and sewer bills cost more than double the national averages. As is the case in West Virginia and other states, these rising costs tend to cover infrastructure repairs.

The top 5 states with the least expensive utilities

1. Wisconsin: $427 | 6.21% of income

Wisconsin residents pay an average of just $19 per month for sewer services, which is the lowest cost in the nation. Water is just as affordable, costing an average of $20 per month. Meanwhile, electricity and natural gas prices have increased year over year but remain well below the national averages.

2. New Mexico: $401 | 7.5% of income

New Mexico was one of just a handful of states to see a year-over-year drop in electricity prices. Residents of The Land of Enchantment pay an average of $93 per month for electricity, which is the second-lowest price in the nation. New Mexicans also pay the second-lowest cost for sewer services. All other utility bills in this state rank at or below average.

3. North Dakota: $456/mo. | 6.21% of income

Electricity prices decreased slightly year-over-year in North Dakota, but a rise in natural gas prices means most residents saw their utility bills increase by $51 per month. Below-average water, sewer, and internet prices help to balance out the above-average cost of natural gas in The Peace Garden State.

4. South Dakota: $441 | 6.63% of income

As with North Dakota, South Dakota's total utility costs increased year over year largely thanks to a rise in natural gas prices averaging about $14 per month. That said, natural gas, water, sewer, electricity, and internet prices remain well below national averages in The Mount Rushmore State.

5. Minnesota: $475/mo. | 6.17% of income

Despite frigid winters and steamy summers, Minnesota keeps utility costs low, spending about 2% less on electricity than most states. In 2025, residents of The North Star State saw a spike in natural gas expenses. Electricity, water, and sewer costs also increased year over year, resulting in a total average rise in utility costs of $53. Still, most utility expenses remain below national averages.

How to save money on your utility bills

Before we dig into the factors that impact how much they cost, here’s a handful of ways to save money on your utility bills every month:

- Call around and shop providers to get the best price.

- Adjust your thermostat or get a smart thermostat to automatically lower and raise your home's temperature based on your schedule.

- Swap out your light bulbs with energy-efficient replacements.

- Unplug electronics you’re not using.

- Invest in solar panels for your house for long-term savings.

- Replace your water heater if it’s more than 10 years old.

- Replace or clean your home’s air filters once a month to every 3 months.

- Address leaks and drafts in your home.

- Get an energy audit or HVAC maintenance checkup.

- Wash your clothes in cold water.

- Replace old appliances.

How to save money on utility bills by service type

How to save on heating and cooling costs

The US Department of Energy’s Energy Saver Guide has detailed tips to help you save on heating and cooling costs. But if you’re short on time, here are some of the top highlights and takeaways:

1. Seal air leaks

Homeowners can save 10%–20% on heating and cooling bills by sealing air leaks around walls, ceilings, doors, fixtures, switches, electrical outlets, and windows. Take a look at these areas in your home and caulk, seal, and weatherstrip all seams, cracks, and openings to the outside.

2. Insulate your home

Properly insulating your home reduces the heat flow through the parts of the home that separate the interior from the outside. Consider adding insulation between the indoors and outdoors to reduce energy and save money.

3. Adjust your thermostat

You can save up to 10% per year on heating and cooling by turning your thermostat down 7°–10°F for eight hours a day in the fall and winter.3

4. Get a smart thermostat

Smart thermostats let you schedule temperature adjustments and track your energy use right from your mobile device. Just keep in mind that they work best in homes with a furnace and/or central air conditioning.4

In 2023, about 16% of U.S. homes had smart thermostats. You can get the most out of these devices by reaching out to the manufacturer to learn optimal programming for maximum efficiency. It’s also helpful to coordinate with utility companies to stagger schedules and prevent strain on the electrical grid, according to recent Cornell University findings.

How to save on your average electric bill

Saving on your electric bill doesn’t have to mean big changes—there are plenty of ways to help reduce costs, from simple adjustments to energy-efficient upgrades.

One of the most impactful changes is installing solar panels, which can cut down your electric bill and even increase your home’s value. Google’s Project Sunroof lets you estimate your potential savings from going solar, and websites like Solar Power Authority can help you find and compare local solar installation companies.

In addition to installing energy-efficient systems like solar or geothermal, here are some quick, affordable ways to help conserve the electricity your household uses.

1. Use your ceiling fan

Switching your ceiling fan’s direction with the seasons can boost energy efficiency and lower your energy bills. In the summer, set the fan to spin counterclockwise to create a cooling breeze. In winter, reverse it to clockwise at a low speed to push warm air down, keeping rooms cozy and helping your heating system work more efficiently.

2. Avoid using the oven in the summer

Who wants to sweat over a hot stove in the summer? You can stay cooler and save money by putting your oven on pause in the hottest months. Cooking with an oven uses more energy than a microwave, air fryer, or grill, and it forces your air conditioner to work harder to keep your home cool during the summer months.

3. Keep shades or blinds closed during the day

About 30% of a home's heating energy is lost through windows.5 Keeping your blinds closed during the day, especially when the sun is the brightest, will prevent heat from radiating through the windows. Look for styles and colors that help your window coverings deflect the most heat.

4. Use a power strip with a switch

You exert energy just by standing around—and so do your appliances. Appliances draw energy even when they’re sitting idle, accounting for 5% to 10% of residential energy use each year.6 Using a power strip with a switch lets you easily turn off multiple appliances at once when they’re not in use—or you can simply unplug individual items to save on your home’s electricity.

How to save on your gas bill

On top of installing one of the smart thermostats we mentioned, you can cut down on natural gas costs by regularly replacing your air filters and scheduling annual furnace maintenance. These small steps can make a big difference.

1. Replace your air filters at least once every one to three months

Your HVAC’s air filters get dirty and clogged over time, forcing systems to work harder. Clean or replace your furnace and air conditioner system's filters once a month to every three months for optimal performance. Replacement can lower your air conditioner's energy consumption by 5% to 15%.7 Before you go shopping, make sure you know what size filter you need. Here are some of the most common air filter sizes:

2. Clean air conditioner coils

Outdoor condenser coils get dirty over time, so it’s important to remove any dirt or debris that collects. Clean the coils, remove debris, and trim nearby foliage back at least two feet to allow for adequate airflow.

3. Get annual maintenance for your HVAC systems

Just like your car needs regular maintenance to avoid costly repairs, so does your HVAC system. While installing a new HVAC system can cost $5,000 to $10,000, an annual maintenance checkup runs about $75 to $200—helping you keep things running smoothly and saving you money in the long run.8 Consider scheduling yearly HVAC checkups to keep your system efficient and avoid future headaches.

How to save on your water bill

The typical water bill costs an average of $47 per month in the US. If you’re looking to combat water costs, focus on the appliances that use the most water and think about where you can reduce usage. Small changes can make a big impact.

1. Fix leaks

The average family can lose up to 180 gallons of water per week—over 9,400 gallons a year—due to common household leaks.9 The usual culprits? Kitchen and bathroom faucets, shower hoses, toilet flappers, hot water tanks, and supply lines. Check out this plumbing repair cost guide to see how much repairs for these common leaks might cost.

2. Replace fixtures with WaterSense products

You could save more than $380 annually from retrofitting with WaterSense-labeled fixtures and ENERGY STAR-certified appliances.9 Here's how much WaterSense-labelled products can help you save water and money:

- Save 4 gallons of water every time you take a shower.

- Faucets and aerators can save 700 gallons of water per year (and are 30 percent more efficient than standard faucets while still providing sufficient flow).

- An irrigation controller can save your home up to 15,000 gallons of water annually.

3. Turn off the tap while you brush your teeth

This age-old water-saving tip may not sound like much, but apparently, turning off the tap while brushing your teeth can save eight gallons of water per day.9

4. Collect rainwater for your landscape needs

Homeowners use between 30% and 70% of their water outdoors, depending on the region.10,11 It may seem like a no-brainer, but you can use water that collects on your roof or other catchment areas to water your lawn or clean your car. All you need is a barrel, which costs around $50–$200 at your local hardware store or online, plus a few simple rainwater harvesting tips.

5. Water lawns early morning and after the sun goes down

It's best to water lawns and landscapes early in the morning and when the sun goes down in the evening. Watering during this time prevents evaporation during the hottest parts of the day (and keeps you from burning your plants). Other watering tips:

- Use native plants or plants that don’t need a lot of water.

- Plant turf grass only in recreation areas.

- Organize your landscape into hydrozones with a different watering schedule for each.

How to reduce your trash bill

The best way to reduce what you spend on trash collection is to reduce your waste. Here are some tips on how to reduce your trash:

- Use reusable water bottles and food containers.

- Cook at home; limit ordering in or frequenting drive-thrus.

- Buy in bulk.

- Reduce purchases that come in plastic containers.

- Thrift, rent, and reuse items.

- Go paperless.

- Bring reusable shopping bags to stores.

- Compost to reduce food waste.

How to save on your internet bill

Similar to paying for channels you don’t watch, it’s possible you could be paying for internet you don’t use. If that’s you, consider reducing your internet speed or lowering your data usage. According to Reviews.org, other ways to save on your internet bill include:

- Buy your own modem and router.

- Bundle internet and TV.

- Shop around and compare prices.

- Cancel your cell phone data plan.

- Negotiate your bill.

- Ask for discounts.

- See if you qualify for subsidies.

How to save on your cell phone bill

One of the best ways to save on your cell phone bill is by watching for promotions from mobile carriers. You’ll often find deals on phone plans—and even new smartphones—when you add a line or switch carriers.

If you don’t need a lot of mobile data, consider a prepaid plan. These are usually more affordable than standard plans, and most major carriers offer prepaid options to help you save.

Average costs by service FAQ

According to the US Energy Information Administration, the average cost of energy in US households was about $117.46 a month in 2020—with nearly half of that money going to heating and cooling (which went up to $136.84 in 2023). Though the average cost of natural gas to power homes in US households dropped to $69.38 per month 2023, compared to $90.62 per month in 2022, due to increased production.

While your energy source determines the energy cost you pay, your bill also depends on inflation, geopolitics, and how much energy you conserve. Here are some other important factors to consider:

- Location. Where you live and the climate you exist in play a significant role in heating and cooling costs.

- Home size. Heating and cooling a small apartment with modern windows and proper insulation costs less than heating and cooling an older, larger home.

- Age of appliances. Old systems and appliances are one of the largest contributors to higher energy consumption.

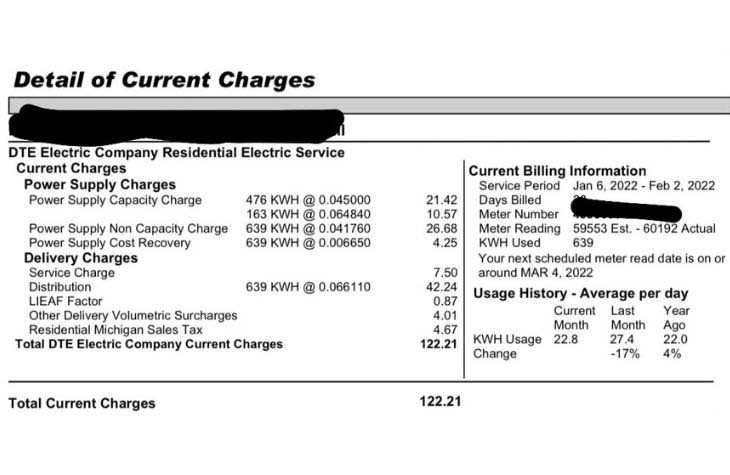

Heating bill charges and usage vary by utility provider and by region. Here is a sample winter electric bill for two people living in a 1391-square-foot home in Wayne County, Michigan.

The average monthly electric bill in the US is $136.84. In 2023, the average price per kilowatt-hour (kWh—the unit of measurement for electricity) for the residential US was 12.68 cents, down from 13.72 cents in 2021.

Some appliances and electronics use more power than others

It may come as no surprise that running an electric clothes dryer uses more kWh than charging your mobile phone or using other small electronics. Silicon Valley Power (a municipal utility provider in California) breaks down energy use by appliance.

Energy use by appliance

Data from Silicon Valley of Power, City of Santa Clara. Data from January 2022.

In 2023, the average US household spent an average of $69.38 per month on natural gas, down over $20/mo compared to 2021, though costs can vary by state.

If reading your natural gas bill feels like decoding a science report, focus on the basics—starting with BTU, or British Thermal Unit, a common measure of energy. Beyond BTUs, your bill may include other items, like taxes. Check with your local provider to get a clear picture of what’s included in your bill.

The average American water bill was $37 per month in 2023, slightly lower than $39.16 per month in 2022, but cost varies based on where you live. Americans use an average of 82 gallons of water a day at home.9 The best way to see how much water you’re using is to look at the breakdown of charges on your water bill. Check out this guide to help you decipher what each of those charges on your water bill means.

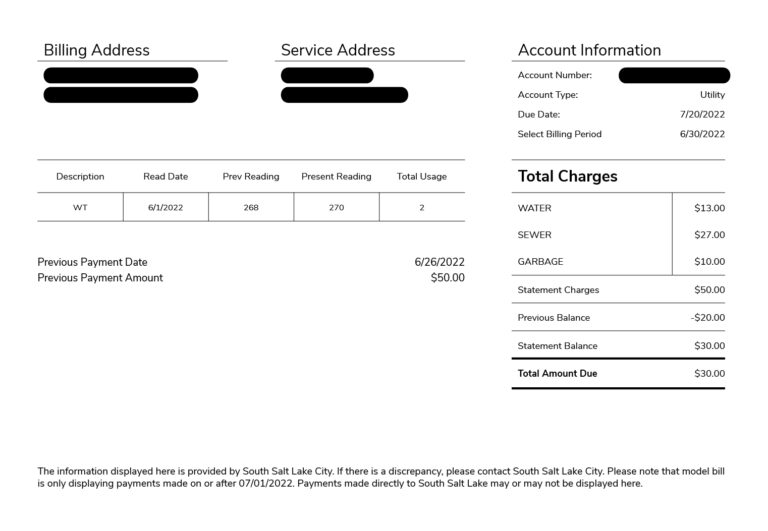

Water charges and usage vary by utility provider and by region. Here is a sample water bill from two people living in a 1,900-square-foot home in Salt Lake City, Utah.

The average US sewer bill runs around $65 per month, though costs vary based on your water source and wastewater treatment setup. Most households (about 283 million people) rely on public water supply, paying for both water use and drainage into the public sewer.11 In some areas, you may see water, sewer, and trash charges combined into one monthly fee.

For those using well and septic systems (15% of US households), costs come from installation, maintenance, and septic tank servicing rather than a monthly bill.12

A recent survey by Bluefield Research shows that combined water and wastewater bills have risen 4.2% annually over the past nine years. To manage these costs, utilities are increasingly adopting tiered pricing, aiming to make essential water usage more affordable.

Here are some ways to save on sewer charges:

- Do larger loads of laundry less often. Try designating one laundry day a week and throwing every single dirty item into the wash. Washing a full load of laundry is the most cost-effective way to save on water costs. Reducing your total number of loads each year by 25% could save 3,227 gallons of water.

- Wash clothes in cold water. Simply, hot water requires more energy. It might not seem like much, but washing your clothes in cold water could save you $60 a year.

- Run the dishwasher when it’s full. Reduce wastewater by queuing up the dishwasher only when you’ve placed every dish and utensil you can possibly fit into it without overloading.

The average homeowner typically pays between $25 to $100 per month for residential trash and garbage collection services, depending on the location and size of the container.

One of the easiest ways to get rid of belongings in your home is to reach out to a junk removal company, which donates and recycles things like furniture and appliances that may be of use to others. Check out your options and estimated costs in our guide to the average cost of junk removal.

You can also donate items to various charities for reuse.

What about recycling?

About half of Americans have access to curbside recycling, typically costing around $4 per month.13 Yet, the national recycling rate stands at just 34.7%, with only 9% of plastic actually being recycled. Since the 2018 halt on plastic imports, the recycling industry has faced significant challenges, leading many communities to choose landfills over recycling for cost and convenience.

While recycling generally produces a lower carbon footprint than landfills or incineration, the environmental benefits depend on the materials recycled and the resources involved.

Here's a rundown of things you can recycle:14

- Clean and dry PET plastic bottles (the bottles labeled "number 1" that water and soda are usually sold in) and HDPE milk jugs

- Aluminum and steel cans

- Paper, newspaper, and magazines

- Glass bottles and containers

- Flattened cardboard and paperboard (clean and without liners)

The average internet bill is around $77 per month, which is the same as last year. The monthly cost of your internet will vary widely based on connection type and speed. Slower dial-up connections cost as little as $10 per month, but the fastest fiber optic connections can cost up to $150 each month.15

The average phone bill in the US is $66 per month, but you can expect to pay as little as $60 for a single line per month to $240 per month for a family of four.16,17

Americans now spend an average of $66 monthly on streaming services—up about $7 from last year. With over 100 options, from on-demand giants like Netflix and Prime Video to live TV platforms like Hulu + Live TV and YouTube TV, and network apps like HBO Max and ESPN+, it’s easy to see how costs can add up fast.

To learn more about what each type of service offers, pricing, and top providers, check out this guide to the best streaming services. And for tips on saving on your streaming bill, don’t miss these 10 money-saving ideas.

How much does cable TV cost?

While streaming accounts for nearly 33.7% of total television consumption, according to Reviews.org, nearly 54% of Americans are still paying for cable television (roughly $83 a month), often in addition to their streaming service bills.18,19

While this article doesn’t cover rent, it’s a big part of your budget. To see how much rent can vary, check out our article on the US cities with the lowest cost of living. For a deeper dive, explore our guide on the least livable US cities for minimum wage earners, where we break down the average rent for a one-bedroom apartment in the most populous cities.

Get credit for paying your utility bills

Until recently, paying utility bills on time didn’t impact your credit score. But now, adding your utility payment history to your credit profile can be a real advantage—especially for those with limited or fair credit. This positive payment history can make a difference when buying a home or securing financing for home upgrades, helping you take that next financial step with confidence.

In 2019, Experian created a free tool called Experian Boost, which connects your utility bills to your checking or savings account (with your permission) and gives you credit for making on-time utility bill payments. With Experian Boost, you can improve your credit score and build a credit history by connecting utility, telecom, and even Netflix bills that you pay every month. Learn more about the service or register for your free credit score report.

At Move.org, we’re here to help you plan your move, find the right moving services, and settle comfortably into your new home. Looking for budget-friendly moving options? Check out these resources to get started:

Methodology

Move.org analyzed the costs of six utilities to determine our rankings: electricity, natural gas, water, sewer, internet, and TV. Our final ranking was weighted using 1) the total cost of utilities in each state and 2) the percent of income paid for utilities based on the median monthly income per state.

We pulled the annual median household income by state from the FRED (Federal Reserve Economic Data) and divided it by 12 to determine the monthly household income.20

The sum of these utilities make up our averages for each state’s total utility costs per month. While we included the estimated average US costs for trash collection and phone, we did not use them in our state rankings.

- Electricity—To determine each state’s average electricity bill, we used US Energy Information Administration (EIA) kww data to find the average monthly electricity consumption for US residents (897 kWh) and multiplied this average by each state’s electricity cost per kWh.19

- Natural gas—The average US home uses 168 cubic feet of natural gas per day. We used this number and the cost of natural gas per cubic foot in each state, according to the EIA, to find the average monthly cost of natural gas.22

- Internet and TV—We used survey data from Reviews.org. and highspeedinternet.com to calculate the cost of both internet, phone TV streaming. 17,18

- . For internet, we found the cost of service that included 60 Mbps, unlimited data, and ADSL.

- Water and Sewer—The US Environmental Protection Agency (EPA) estimates the average American family uses 300 gallons of water per day. We used RentCafe to pull the average monthly household water and wastewater bill for each state.21

Sources

- Jason Lange and James Oliphant, Reuters, "Cost-of-Living Worries Haunt Americans Ahead of Midterms, Reuters/Ipsos Poll Finds." Published October 24, 2025.

- Dominic Covelli, et. al. Applied Energy. "Oahu as a case study for island electricity systems relying on wind and solar generation instead of imported petroleum fuels." Published December 2024.

- US Department of Energy, Energy Saver, “Tips on Saving Money in Your Home,” Published August 2022.

- US Department of Energy, Energy Saver, “Programmable Thermostats.”

- US Department of Energy, Energy Saver, "Energy Efficient Window Coverings."

- US Department of Energy, Energy Saver, "3 Easy Tips to Reduce Your Standby Power Loads." Published February 2022.

- US Department of Energy Energy Saver, “Air Conditioner Maintenance.”

- Glenda Taylor, Bob Vila, “How Much Does a Furnace Tune Up Cost?” Published January 2023.

- EPA, “Statistics and Facts,” Published March 2025.

- EPA, “WaterSense Labeled Homes Outdoors.” Published August 2025.

- US Geological Survey, “Public Supply Water Use.” Published March 1, 2019.

- US Geological Survey, “Domestic (Private) Supply Wells.” Published March 1, 2019.

- EPA, “National Overview: Facts and Figures on Materials, Wastes and Recycling.” Published September 2025.

- Waste Management, “Recycling 101.”

- CostHelper, “Cost of Internet Access.”

- Courtney Lindwall, Consumer Reports, “Best and Worst Phone Plan Providers.” Published September 2025.

- Kelly Huh, Reviews.org, "State of Consumer Media Spending in 2024: Cost of Internet, TV, and Mobile" Published December 2024.

- Chili Palmer, HighSpeedInternet.com, "Report: Cheapest and Most Expensive States for Internet Service in 2024." Published December 2024.

- Thad Warren, Energybot, "Average Electricity Bills in Every State [Ranks for All States + DC]," Published October 2025.

- Federal Research Economic Data "2024: Real Median Household Income by State, Annual."

- Mihaela Buzec, RentCafe, "What Are Apartment Utilities & How Much Will They Cost Me?" Published May 2025.

- US Energy Information Administration, “Natural Gas Prices.” Published September 2025.